by Bob Shively, Enerdynamics President and Lead Facilitator

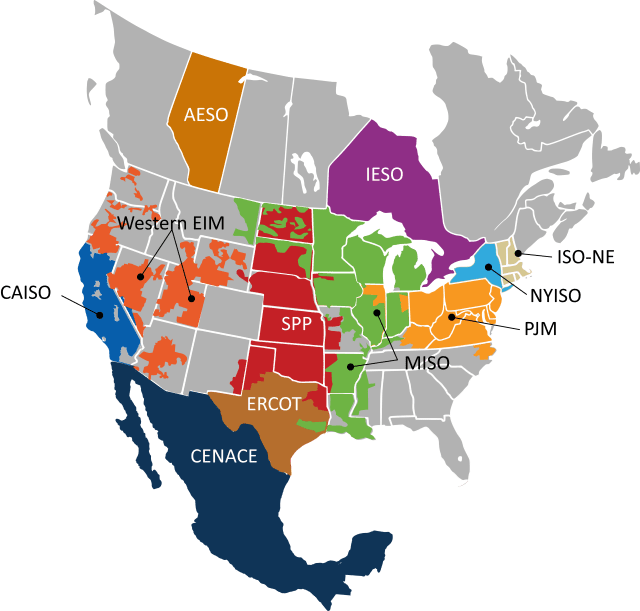

For the last 20 years, it appeared North America was locked into two paradigms on wholesale market design:

- Less competitive unorganized markets centered around vertically integrated utilities, bilateral trading, and transmission wheeling services

- Organized competitive markets run by an Independent System Operator (ISO)[1]

It’s becoming increasingly clear that organized competitive markets are the winning paradigm. Some regions such as the U.S. Southeast and Canadian provinces dominated by vertically integrated utilities are still holding out, but large markets continue to join or are on the verge of joining ISOs. And as use of renewable generation grows and dependence on baseload units fades, the benefits of ISO participation are becoming clear.

This week we’ll look at the recent history of organized market growth and the short-term future of such growth. We’ll continue the discussion next week with a look at why organized markets are winning out and what the long-term future may hold for North America’s organized market structure.

North American regions with organized ISO Markets as of 2017

Organized markets have grown substantially in the last five years

In the last five years, we have seen the following:

- 2013 – Ten transmission companies from the south, including various Entergy utilities and CLECO, joined the Midcontinent ISO (MISO). This added territory across parts of the states of Arkansas, Louisiana, Missouri, Mississippi, and Texas to the ISO that formally operated solely in the mid-west.

- 2014 – The Western Energy Imbalance Market (EIM) was launched by PacifiCorp becoming a participant in the California ISO (CAISO) real-time market. This meant that generation assets across parts of seven western states became available for real-time cost-based dispatch. Subsequently, Arizona Public Service, NV Energy, and Puget Sound joined. Seven more entities including Powerex in British Columbia plan to join between now and 2020, and part of the Mexican grid in northern Baja California is studying participation as well.

- 2015 – The Southwest Power Pool (SPP) added the Upper Great Plains region including parts of Iowa, Montana, Minnesota, Nebraska, North Dakota, and South Dakota. Much of this system was previously operated by the Western Area Power Administration and this expansion marked the first time a federal power agency had joined an ISO.

- 2016 – Mexico implemented electricity reform including creation of Centro Nacional de Control de Energía (CENACE), a country-wide ISO running day-ahead and real-time markets.

Organized markets are poised to grow significantly more in the near future

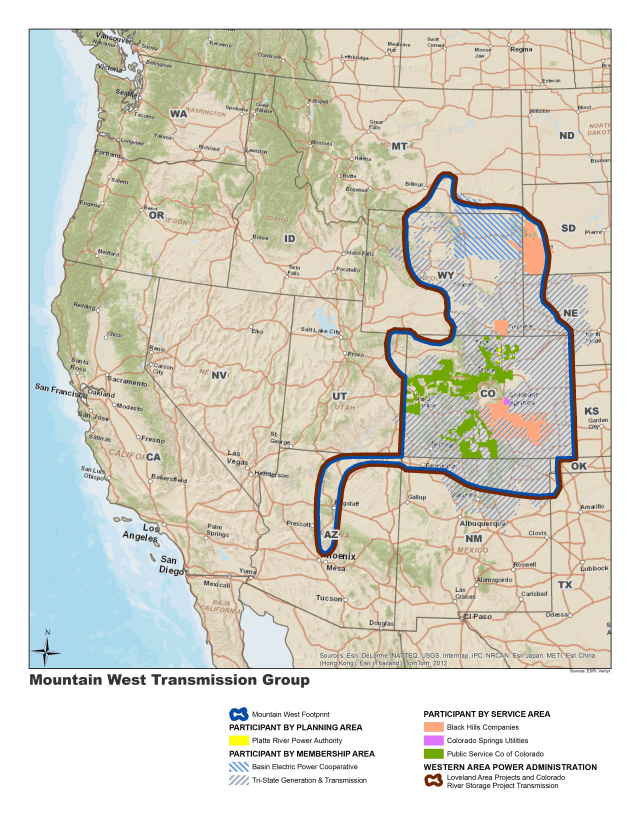

It doesn’t appear that growth in organized markets will slow anytime soon. PacifiCorp and CAISO are working toward PacifiCorp becoming a full member of CAISO. If it comes to fruition, it appears that other utilities may soon follow. Efforts continue to develop CAISO into a full western regional electric market. And recently, the Mountain West Transmission Group, comprising eight utilities and two WAPA divisions, announced a non-binding letter of intent to hold detailed discussions with SPP. SPP reportedly was selected after consideration of CAISO or PJM as possible partners. The entities could join as soon as 2019.

Source: WAPA website

Source: WAPA website

Next week we’ll continue this look at ISO expansion and answer two key questions:

- Why the movement to organized markets?

- Will all of North America become an organized market?

Footnotes:

[1] In this blog we are using the term ISO as a synonym to a Regional Transmission Organizatoin or RTO

you look. In certain parts of the country, there seems to be a growing focus on DR; in others, market forces are reducing the value of DR. In some areas DR is viewed as a resource competing in capacity markets whereas in others it is a resource included in utilities’ integrated resource planning.

you look. In certain parts of the country, there seems to be a growing focus on DR; in others, market forces are reducing the value of DR. In some areas DR is viewed as a resource competing in capacity markets whereas in others it is a resource included in utilities’ integrated resource planning.

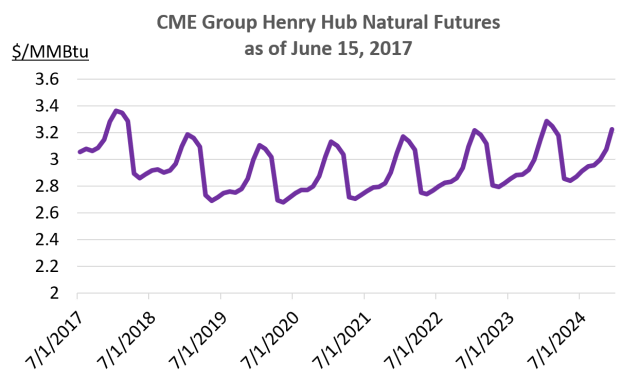

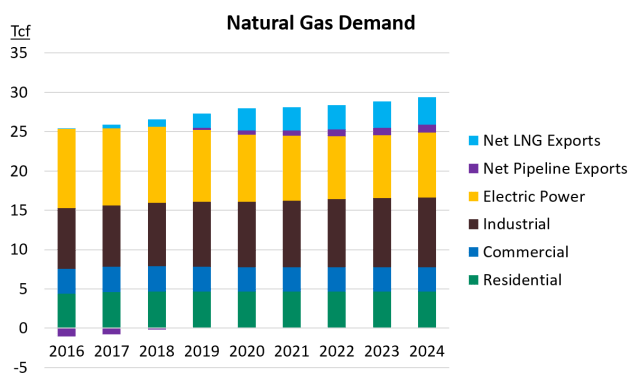

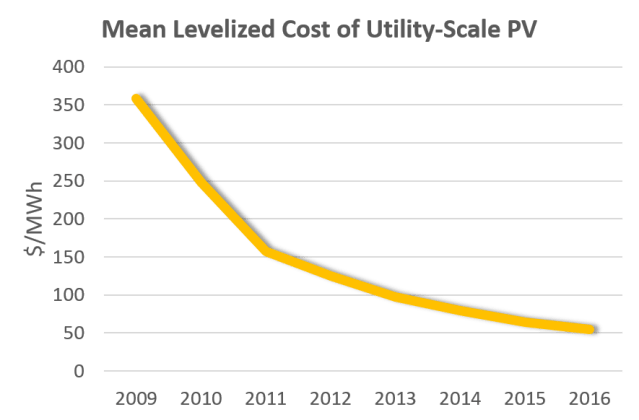

from NextEra Energy Resources for a 100 MW solar project combined with a 30 MW/120 MWh battery storage system. The all-in price is reportedly less than $45/MWh. Why is this news? Because TEP can purchase solar power, store it, and shift it to the system peak at significantly less than the cost of running a gas peaker. This begs the question: Are solar/battery combinations poised to displace gas peakers as a resource for meeting system peak demands? Below are some key discussion points that may help answer this question.

from NextEra Energy Resources for a 100 MW solar project combined with a 30 MW/120 MWh battery storage system. The all-in price is reportedly less than $45/MWh. Why is this news? Because TEP can purchase solar power, store it, and shift it to the system peak at significantly less than the cost of running a gas peaker. This begs the question: Are solar/battery combinations poised to displace gas peakers as a resource for meeting system peak demands? Below are some key discussion points that may help answer this question.

Agreement on climate change action[1] was greeted by predictable comments from the agreement’s supporters and opponents. But more meaningful was the reaction of various entities who will have much to say about what happens with America’s actual future emissions. Within days, states, cities, counties, universities, non-governmental organizations, and businesses stepped forward to pledge to work together to see the U.S. meet its goals with or without support from Washington.

Agreement on climate change action[1] was greeted by predictable comments from the agreement’s supporters and opponents. But more meaningful was the reaction of various entities who will have much to say about what happens with America’s actual future emissions. Within days, states, cities, counties, universities, non-governmental organizations, and businesses stepped forward to pledge to work together to see the U.S. meet its goals with or without support from Washington.