by Bob Shively, Enerdynamics President and Lead Facilitator

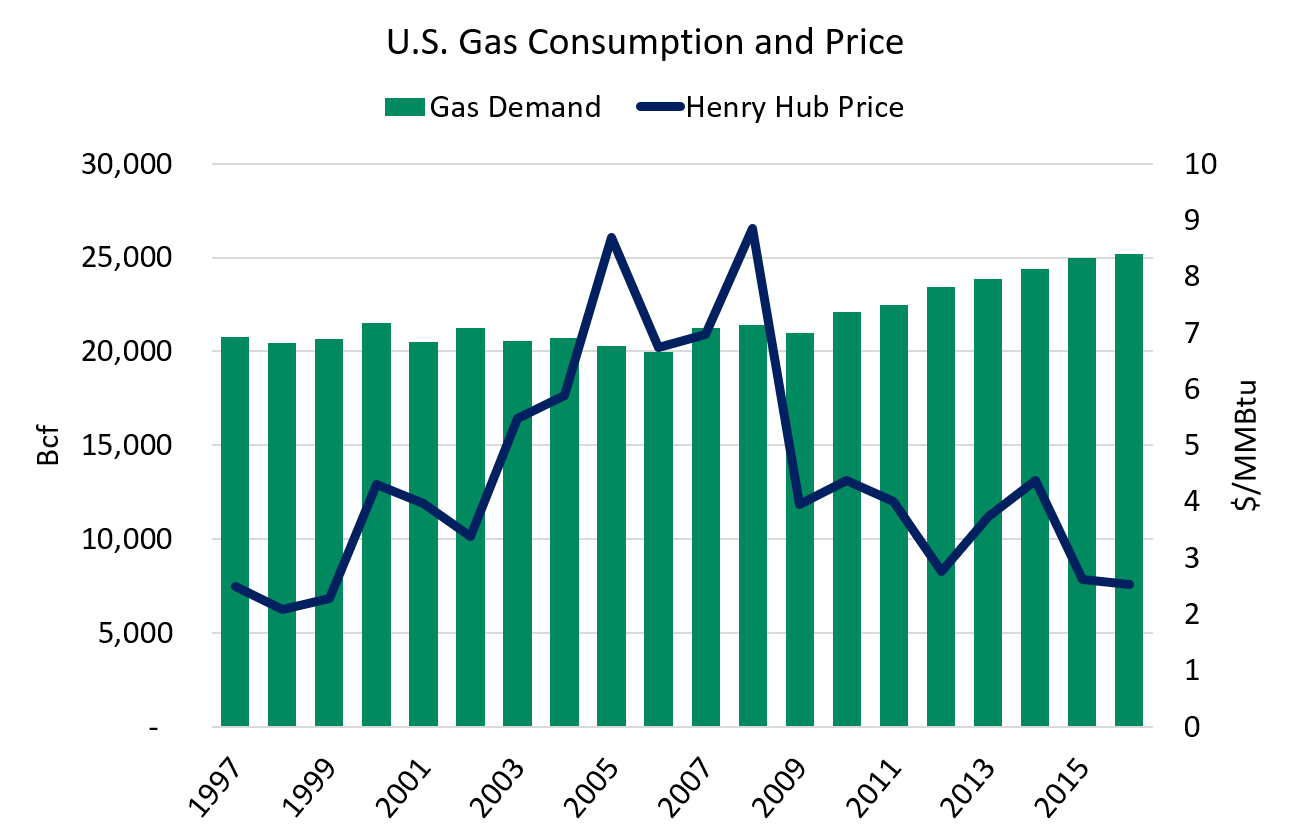

A basic concept of economics is that when prices go down, demand goes up. This certainly has been true for U.S. natural gas in recent years:

Robust supply delivered by shale gas has driven down prices, and projections tell us we can expect this robust supply to last well into the future. But it appears that U.S. domestic gas demand may not have much more room for growth. For now, the great hope for the gas industry appears to be growth in exports.

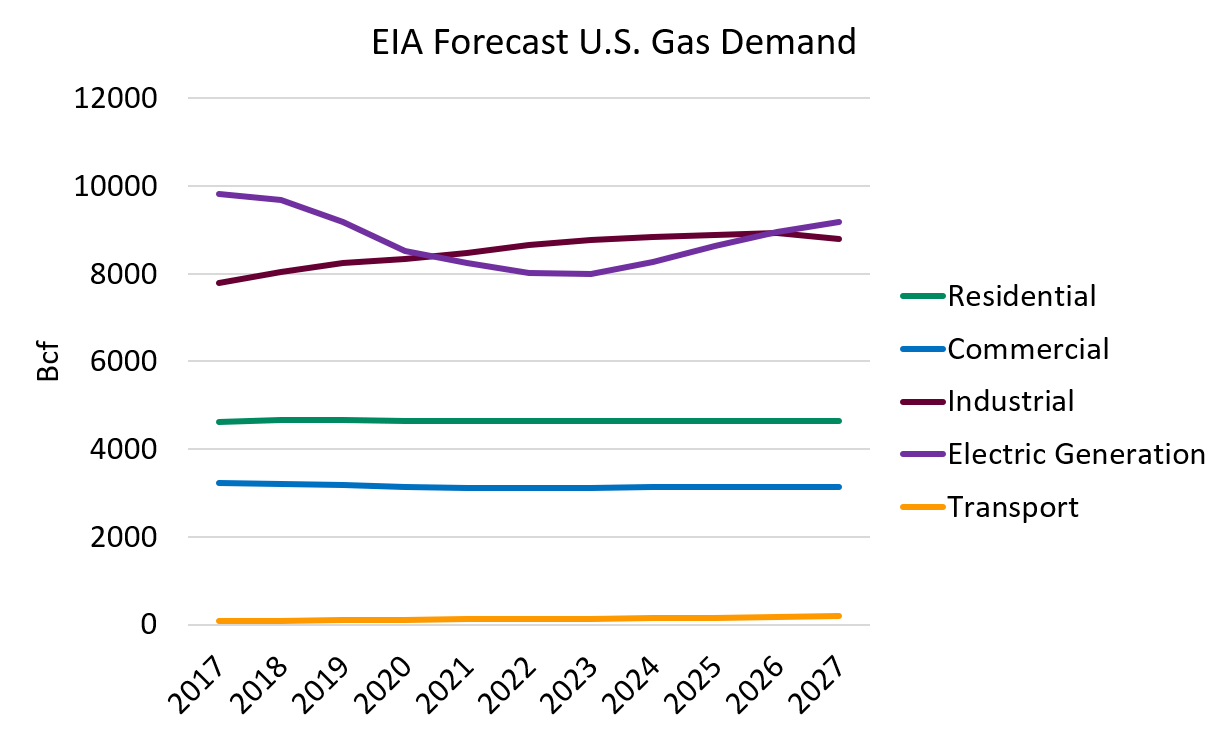

The EIA predicts that:

- residential and commercial use will remain flat

- transport use will grow but will remain a small factor in overall consumption

- industrial use will grow slowly

- electric generation use will decline initially given growth in renewables and price competition with coal power plants before growing again in the mid 2020s

Let’s consider variables affecting demand in each sector.

Residential and Commercial

Residential and commercial demand in the short term is mostly driven by weather. Assuming weather patterns don’t change much in the next few years and that efficiency continues to improve, there is little expectation that demand in these sectors will grow.

Industrial

Growth in gas-heavy industries such as chemicals and refining may continue if gas prices remain low. Petrochemical plants currently planned for or under construction suggest that industrial demand will continue growth similar to that of recent years. But other factors affect industrial growth including economic conditions and the costs of other feedstock and fuels. A shock in any of these areas could halt demand growth.

Electric generation

Unlike the other sectors, there is more uncertainty around electric generation. Electric load growth has been stagnant since 2008 and appears it will remain that way in the short term. Without electric load growth, the potential for generation gas demand is simply a question of how gas generation compares to other generation sources, notably renewables and coal.

Renewables are expected to continue rapid growth, which has the potential to cut into gas generation output. And if gas prices rise, coal generation becomes more economic than gas generation for existing units. We have already seen some fuel switching from gas back to coal and will likely see more in the next year. If coal and nuclear unit retirements occur as planned, most of their generation will be replaced by gas output. But if policies emanating from Washington delay retirements, this too could drive down gas use.

Transport

Natural gas has potential for use as a transport fuel for fleet vehicles, heavy trucks, railroads, and shipping. While this potential is large, the infrastructure required is significant and would take many years to build out. So, transport is not expected to be a significant source of demand in the near term.

Exports

Exports are the biggest hope for short-term demand growth. With one major LNG export facility already in service and six more slated to come online in the next two years, U.S. LNG export capability will grow significantly. What’s uncertain is how much gas will flow through these facilities – it will depend on global market conditions including gas prices in other supply regions of the world and demand in regions such as Asia, Europe, and South America.

Exports to Mexico are more predictable. Mexico’s use of natural gas is growing rapidly, and the availability of low-cost U.S. supplies through an expanding pipeline network is quickly bolstering Mexico’s use of U.S. natural gas. The combination of LNG and pipeline exports could boost overall demand for U.S. supply by as much as 20% in the next decade. But even this good news is tempered by concerns that push from the current U.S. Administration to renegotiate NAFTA could interrupt or restrain future gas trade between the two countries.

Are there dark clouds on the horizon?

With expanding exports, the future for natural gas in the U.S. looks robust. But, there are ominous factors that cannot be ignored.

There is the distinct possibility that in the longer term, gas-fired generation will shrink. While at least half of the coal capacity in the U.S. is expected to retire in the next decade, renewables are rapidly growing and continue to cut into gas generation run hours. And, for the first time ever, both utility-scale wind and utility-scale photovoltaic units have lower long-term levelized costs than gas units.

In states with robust renewable resources, some analysts foresee a future where existing gas units are no longer needed. Many still believe that gas units will be required to provide system flexibility for variable renewables, but even under this scenario the number of hours of use gets less and less. And system operators are rapidly developing other means of managing renewables including scheduling across large geographical regions, incenting flexible loads to match usage to renewable output, and implementing thermal and battery storage. And, once most of the coal generation is retired, the next big source of greenhouse gas emissions (GHG) in the electric industry will be gas-fired units. Already we have seen the construction of new units in California fall into question based on carbon emission goals.

Second, in states with significant GHG emissions goals, one way to reduce emissions is to use electricity for space and water heating instead of gas. Given that water and space heating loads make up around 90% of residential and commercial demand, such a shift could result in a significant loss of business for the gas industry.

In some regions, gas utilities already are considering a future with reduced natural gas usage. Some are encouraging growth of renewable natural gas. Others are looking into power-to-gas technologies that would use renewable electricity to power an electrolysis process to create hydrogen that could be delivered through the existing gas infrastructure. While the short-term outlook appears rosy, now may the time for gas companies to plan for what could be a very different future.

As climate change continues to follow the million year pattern of glacial cool downs and interglacial warm ups the eventual change into the next glacial cooling cycle will increase the demand for gas. Even the UN IPCC predicts about a 2 degree rise in average earth temperature, which is about equal to the highs of all interglacial warmups of at least the past 400,000 years. Since the average earth temperature is not following the extreme increase in greenhouse gasses as was predicted, maybe science just does not yet comprehend the earth’s reaction to “man caused” input. I have complete confidence in the ability of science to advance in its knowledge and believe 100% that someday they will be able to create the computer models that will correctly predict when the next glacial cooling cycle will begin.