by Bob Shively, Enerdynamics President and Lead Facilitator

Our last blog post discussed the transformation from an electric grid driven by centralized generation to a grid powered by distributed energy resources (DER). For this transformation to successfully occur, industry insiders must understand the many services that DER must provide if and when it becomes a primary energy resource.

As shown in the table above, these services can be divided into energy-related services and network-related services. Last week we looked at what each energy-related service entails. We continue this week by outlining each network-related service.

As shown in the table above, these services can be divided into energy-related services and network-related services. Last week we looked at what each energy-related service entails. We continue this week by outlining each network-related service.

Network-related Services

- Voltage control: In addition to providing real power (kW) to match consumer loads, electrical systems must provide reactive power (vars) to match the consumption of reactive power by electrical lines and by certain types of loads (electric motors, fluorescent lights for instance). Reactive power historically has been provided by central generators and/or by devices on the distribution system such as capacitor banks. Voltage control is the ability to provide vars to the system as needed.

- System support during disturbances: A disturbance on a distribution circuit often results in voltage dips below normal levels. These dips may be temporary in nature. DERs are often set to isolate themselves from the grid when low voltage occurs. But this makes the problem worse as sources of supply are removed from the system. DERs designed to ride through low voltage can provide a benefit of helping keep the system voltage from dropping to the point that the circuit automatically takes itself out of service and causing a blackout.

- Power quality: Distribution utilities strive to deliver electricity with high power quality meaning that voltages and currents follow a consistent pattern. But various consumer devices can result in localized impacts on the power on a specific distribution circuit, including variation in voltage magnitudes, voltage dips and spikes, or variations in wave shapes. DER can be beneficial or harmful to power quality depending on the design of DER inverters and on operational practices.

- Energy loss reduction: Power that is delivered from a generator to a load results in losses along the transmission and distribution system. Energy loss reduction is production of energy at or near the consumer that provides a reduction in system losses.

- Mitigation of constraints: The lowest cost source of supply cannot always be used due to lack of transmission capacity to deliver the supply to loads. Production of energy at or near the consumer can provide resources that can be used to mitigate constraints on the transmission system.

- New T&D capacity deferral: Growth of loads can result in the need to upgrade transmission and distribution facilities. These upgrades can sometimes be costly. Production of energy at or near the consumer can provide supply that does not require T&D capacity for delivery to the consumer. If located in the right spot, DERs can be used as an asset to avoid or delay having invest in system upgrades.

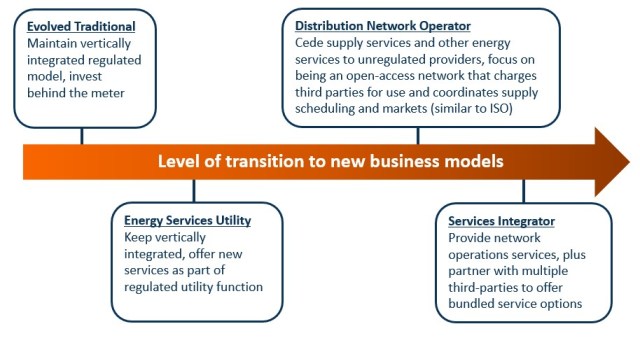

Attracting these services from DER will require significant changes to current regulatory and business arrangements; both the utilities that operate the networks and the owners of DER must be incented to take advantage of the services that distributed resources can provide, and owners must be paid appropriately for the benefits that DER assets bring to the system. We will explore these issues in future articles.

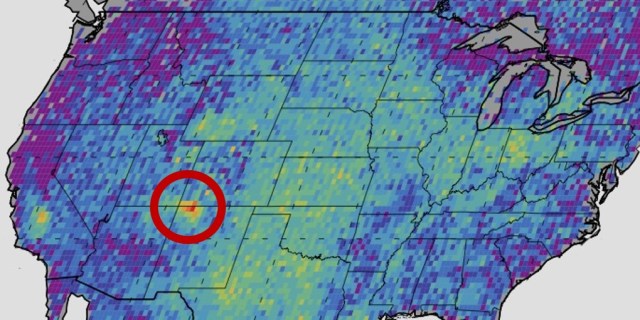

Source: NASA/JPL-Caltech/University of Michigan

Source: NASA/JPL-Caltech/University of Michigan

than 226 million registered vehicles in the U.S. But,

than 226 million registered vehicles in the U.S. But,

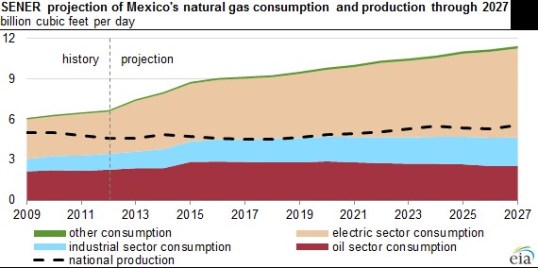

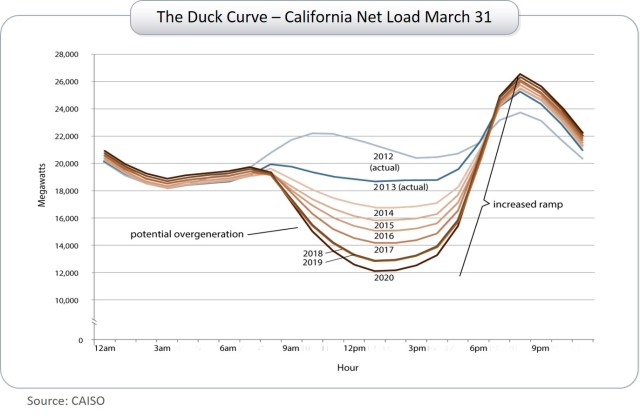

U.S. In the last decade renewables output has shown an average annual growth rate of 32%[3]. In 2015, 67 % of new capacity was made up of wind and solar[4].

U.S. In the last decade renewables output has shown an average annual growth rate of 32%[3]. In 2015, 67 % of new capacity was made up of wind and solar[4].