by Bob Shively, Enerdynamics President and Lead Facilitator

In 2016, annual average natural gas prices in the U.S. were the lowest since 1999.

Source: EIA website

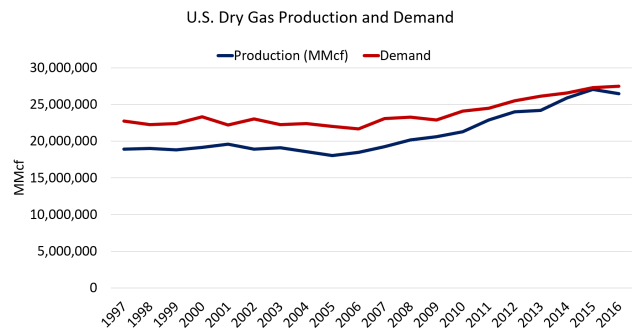

Interestingly, this occurred even with a slight drop in production and slight increases in both demand and exports.

Source: EIA website

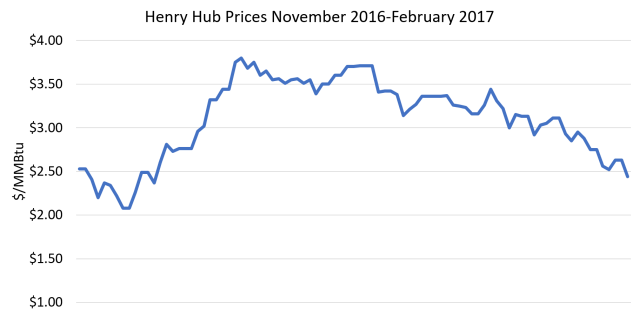

While prices rose a good bit in December due to cool weather, warmer temperatures have pushed prices right back down in recent weeks:

Source: EIA website

Low natural gas prices have had significant impacts on the energy marketplace:

- For the first time ever, electricity generation by natural gas power plants in 2016 was the largest source of generation in the U.S. surpassing coal which has been the leader since the mid-1900s.

- The cost of power generation by gas has fallen to unprecedented low levels. Combined with growing low-cost renewable and solar power in some markets, numerous coal units and even some nuclear units have closed or been scheduled for closure.

- Many independent power products (IPPs) are now questioning whether they can attain enough market revenues to stay in business

- Exports of LNG are now economic as cargos priced at an index to Henry Hub are competitive in world markets.

- Industrial gas demand in the U.S. is at the highest level since the year 2000.

- And both natural gas and electricity consumers have benefited by low utility bills.

Given these factors can we expect that gas prices will continue to stay low, or will prices creep back up? A quick Google search of the phrase ‘2017 gas price forecast’ leads to sites with titles like “Outlook ’17: U.S. natural gas prices could soar” and “Will natural gas go on another run in 2017?”

Natural gas prices are set by the market based on the forces of supply and demand, plus market expectations for the future. So what are the expectations?

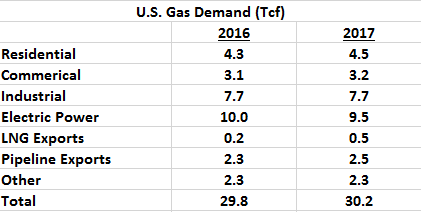

- Demand plus exports is forecast to be flat: According to the EIA February 2017 Short-term Energy Outlook, the level of demand plus exports in 2017 is expected to grow about 1% compared to 2016.

It should be noted that this assumes that electric power generation will fall a bit, primarily because the EIA has forecast a significant gas price increase to $3.54, which makes gas generation less competitive with coal.

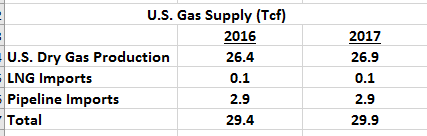

- Supply is forecast to increase slightly: According to the EIA Short-term Energy Outlook, supply is forecast to increase by about 2% due to increasing U.S. gas production.

And indeed, we have seen natural gas rigs actively drilling for gas increase by 50% compared to this time last year, which would indicate that more supply is on the way. Meanwhile, natural gas in storage is about 4% above the 5-year average.

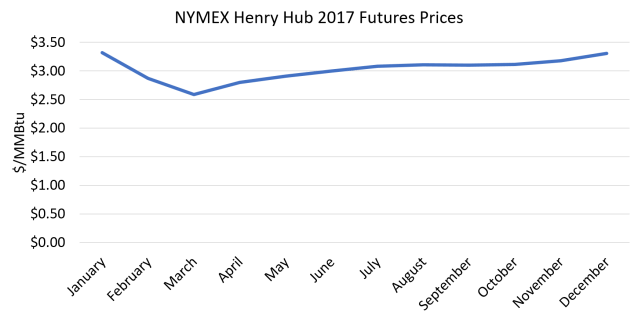

- The natural gas futures market is less optimistic on price than the EIA.

The natural gas futures market, which indicates the current price available today to lock in a purchase or sale of supply in future months, suggests an average 2017 price of $3.03. This is more in line with forecasts from the IMF and the World Bank, which forecasts U.S. gas prices of $3.00/MMBtu for 2017.

- Weather doesn’t look promising to help gas prices in the near term: According to weather forecast maps from NOAA, winter may already be close to over with forecasts for both the next month and the next three months showing temperatures higher than normal for most of the country.

So what can we expect for gas prices in 2017?

With production still strong, heating demand looking low for the rest of this winter, and gas in storage above the five-year average, it doesn’t look optimistic for significant gas price spikes. Much will depend on power plant demand for natural gas, and producers are hoping for a hot summer. Absent that, we would expect gas prices to remain at historic lows. Others disagree and think there is potential for a price run-up. That is the fun of the gas markets — no one knows what will happen until it does!

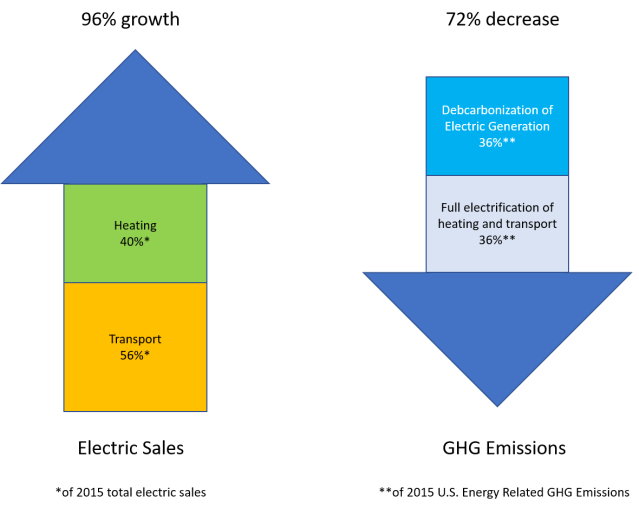

distributed energy, shrinking value for many large centralized power plants, and discussion around changing business models, electric utility shareholders are left wondering from where future earnings growth will come. Meanwhile, despite the current administration in Washington, utilities in many regions are feeling increasing pressure to reduce environmental impacts.

distributed energy, shrinking value for many large centralized power plants, and discussion around changing business models, electric utility shareholders are left wondering from where future earnings growth will come. Meanwhile, despite the current administration in Washington, utilities in many regions are feeling increasing pressure to reduce environmental impacts.

maintain coal-related jobs in the U.S. But as we pointed out in our Energy Insider article

maintain coal-related jobs in the U.S. But as we pointed out in our Energy Insider article

mics Staff

mics Staff

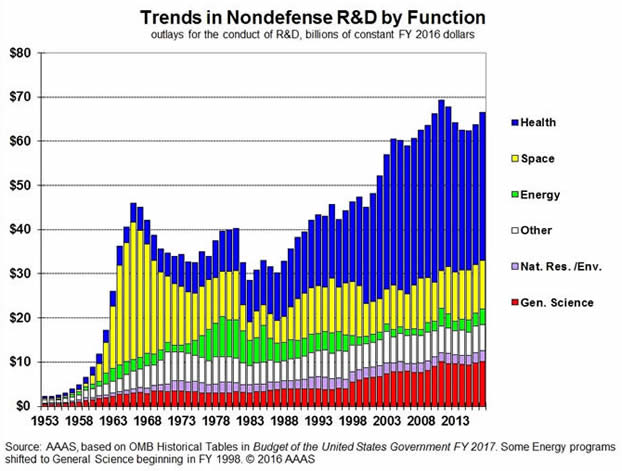

the energy industry,

the energy industry,  other than extending renewable production tax credits. And when Obama attempted to use regulation instead of Congressional action to address greenhouse gases, the EPA’s

other than extending renewable production tax credits. And when Obama attempted to use regulation instead of Congressional action to address greenhouse gases, the EPA’s

Source:

Source: