by Bill Malcolm, guest author

“Gas is from Venus, electricity is from Mars,” quipped Sue Kelly of the American Public Power Association to me in  July at the NARUC Conference in Denver. In a nutshell, this summarizes the complex challenge of helping to better coordinate these two industries.

July at the NARUC Conference in Denver. In a nutshell, this summarizes the complex challenge of helping to better coordinate these two industries.

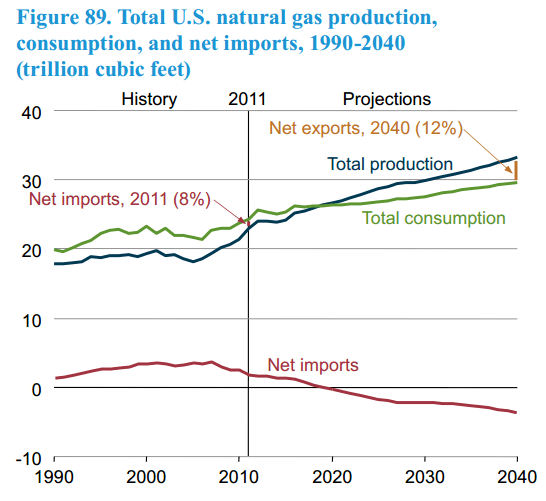

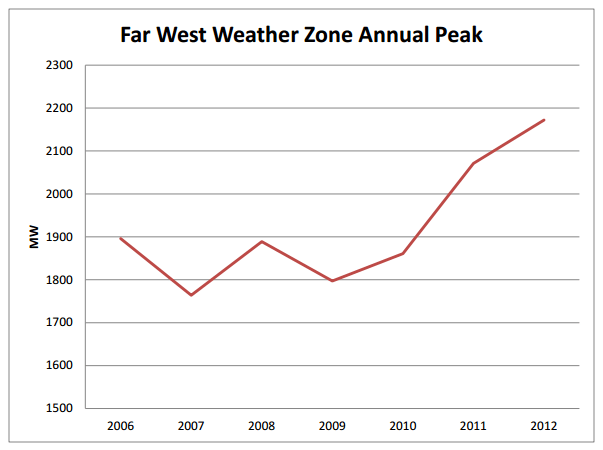

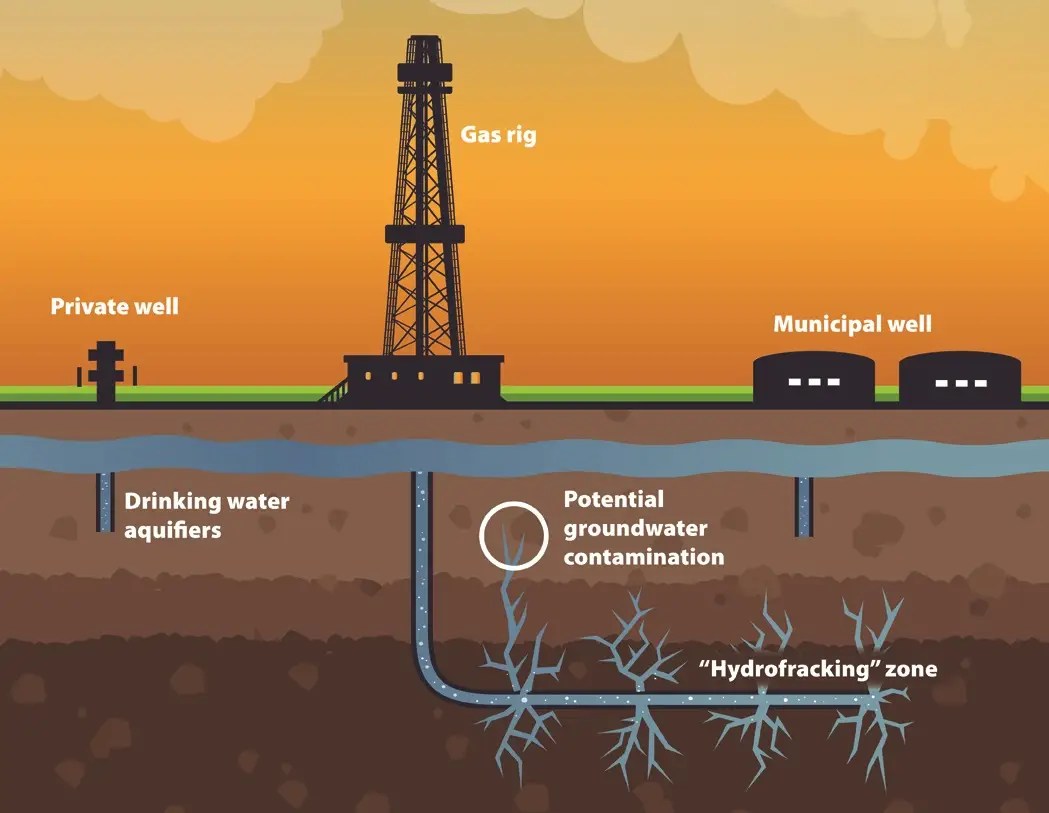

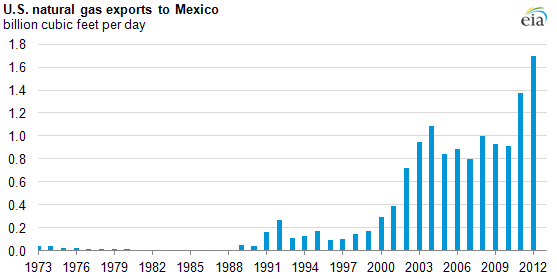

With the increased use of natural gas for electric generation, efforts are underway to better coordinate the way the two industries operate. A quick overview of the two industries shows the issue is as complicated as the two divergent industries:

Resulting concerns include:

- Operators of gas and electric systems don’t know what the other is planning to do on any given day. Better communication (and consistent nomination deadlines) between electric system operators including RTOs and interstate natural gas pipelines may be needed.

- Gas-fired generators that are providing firm capacity and are being counted on by electric system operators may not be able to obtain gas supply when they are dispatched. Requiring gas-fired generators to show they have firm fuel deliverability capability may be something to study.

- On a cold winter day, gas-fired power plants may get curtailed, resulting in electricity outages.

- Planned expansion of gas-fired generation may not result in needed expansion of gas infrastructure.

Next week in Part II of this post we’ll look at what has been done to address these issues and the official stance from each party involved.

About the AuthorBill Malcolm is a 37-year energy industry veteran who has worked for Seattle City Light, Pacific Power, PG&E, ANR Pipeline (now owned by TransCanada), and MISO. He currently is a freelance energy reporter and has a column in The Cruthirds Report (a Houston energy newsletter) on RTO and PSC matters. He holds a M.A. in economics from the University of Washington and a B.A. in economics from UC Santa Cruz. He also is a columnist in the Broad Ripple Gazette and has organized a new group, Hoosiers for Passenger Rail, in an attempt to save the daily Amtrak service from Indianapolis to Chicago.

our jobs. Here at

our jobs. Here at