by Bob Shively, Enerdynamics President and Lead Instructor

“Even without subsidies, certain storage technologies are already cost-competitive with certain conventional alternatives (for example, lithium-ion batteries for certain power grid support applications). Other storage technologies are close to being cost-competitive in other applications, and costs are expected to decline in coming years.”

If industry projections materialize over the next five years, cost-effective energy storage technologies will have increasingly broad applications across the power grid, such as providing an alternative to conventional gas-fired peaking plants in certain areas.

– 2015 Press Release from Lazard

The holy grail of cost-effective electricity grid storage has been a dream for power engineers and system operators since the industry’s infancy. While hydro pumped storage has proven economic for time-shifting supply from off-peak to peak periods when available, other forms of storage have failed to deliver on an economic basis. This equation may be about to change as batteries and other forms of storage develop in performance and come down in price.

As utilities and other market participants consider storage as another tool to deliver reliable and cost-effective service, a key question is how to determine when investments in storage are justified. The difficulty is that the value is made up of multiple potential benefits to the grid. Valuing a power plant is fairly easy: The primary amount of its value is in energy and capacity provided, with a bit more value for various ancillary services. Valuing a voltage regulator on the distribution system is similarly simple as one just has to determine the cost of voltage fluctuations the regulator will eliminate. But the value of storage can include multiple benefits that bridge from supply to distribution and vary by location of the storage device.

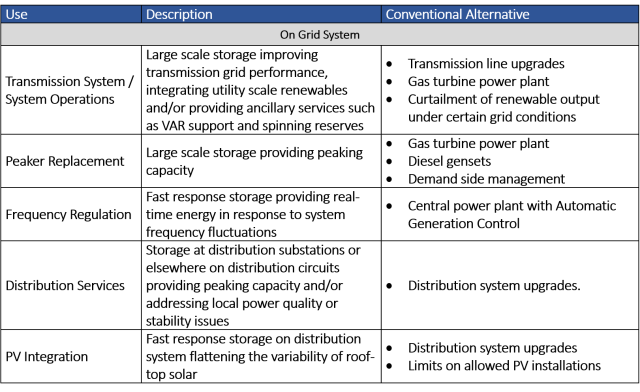

To help potential investors evaluate an investment, the financial advisory and asset management firm Lazard defines specific use cases. These are worth summarizing to help us visualize whether storage may make inroads into power systems and to understand with what other assets storage must compete. Following are the use cases outlined in Lazard’s Levelized Cost of Storage Analysis, with some adaption by Enerdynamics:

As market participants move forward with storage installations, the value of the various storage applications will be more apparent. This will allow potential investors to determine when and where storage has become economic.